Understanding Forex Trading Regulations: A Comprehensive Guide

The world of forex trading is both exciting and challenging, with plenty of opportunities for profit as well as risks. One critical aspect that every trader should be aware of is the regulatory environment governing forex trading. Regulations ensure that the trading market operates fairly and transparently, protecting traders from fraud and enhancing market integrity. In this article, we will delve into the various forex trading regulations that exist globally and the importance of compliance, helping you make informed decisions for your trading journey. Additionally, we will discuss various tools and resources, including forex trading regulations Forex Trading Apps, that can help you navigate these regulations effectively.

What Are Forex Trading Regulations?

Forex trading regulations refer to the laws, guidelines, and rules set by official regulatory bodies that oversee the forex market in different jurisdictions. These regulations serve multiple purposes, including protecting traders from fraud, ensuring fair trading practices, and maintaining market integrity. The regulations may vary significantly from one country to another, depending on local laws, market conditions, and governmental structures.

Importance of Forex Trading Regulations

Regulations in the forex market are vital for several reasons:

- Protection of Traders: Regulations help protect traders from unscrupulous brokers and fraudulent activities. Regulatory bodies typically implement measures to ensure that brokers adhere to strict operating standards.

- Market Integrity: Regulations promote fair trading practices that contribute to the overall integrity of the financial markets.

- Transparency: Compliance with regulations ensures that brokers provide clear and transparent information about their services, fees, and risks associated with trading.

- Consumer Confidence: Knowing that a broker is regulated can significantly boost traders’ confidence in their services, leading to a healthier trading environment.

Key Regulatory Bodies in Forex Trading

Various regulatory bodies oversee forex trading in different countries. Here are some of the most significant ones:

- Commodity Futures Trading Commission (CFTC) – USA: The CFTC is a federal agency that regulates the U.S. derivatives markets, which include forex trading. It ensures that all transactions are conducted fairly and transparently.

- National Futures Association (NFA) – USA: The NFA is a self-regulatory organization for the U.S. derivatives industry, including forex. It establishes rules and regulations to protect traders and maintain market integrity.

- Financial Conduct Authority (FCA) – UK: The FCA regulates financial firms in the UK, including forex brokers. It ensures that companies follow strict compliance measures and prioritizes the protection of consumers.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC is responsible for regulating financial services and markets in Australia, including forex trading. ASIC imposes stringent licensing and reporting requirements on forex brokers.

- European Securities and Markets Authority (ESMA) – EU: ESMA is an independent authority that contributes to safeguarding the stability of the EU’s financial system. It establishes regulations that affect forex trading within the European Union.

Regulation Compliance Requirements

For brokers and trading firms, complying with regulatory requirements is essential. Here are some common compliance requirements:

- Licensing: Forex brokers must obtain licenses from the respective regulatory authorities in their operating jurisdictions.

- Reporting Obligations: Regulatory bodies often require brokers to report their financial results, operations, and trading activity periodically to ensure transparency and compliance.

- Client Fund Protection: Many regulations require brokers to keep clients’ funds in separate accounts to ensure their protection in case the broker faces financial difficulties.

- Anti-Money Laundering (AML) Measures: Brokers must implement robust AML policies to prevent illegal funds from entering the trading system.

- Know Your Customer (KYC) Policies: Regulatory authorities require brokers to verify their clients’ identities to reduce fraud and maintain security on their platform.

Choosing a Regulated Forex Broker

One of the most important decisions you will make as a forex trader is choosing a broker to work with. Here are some vital factors to consider when selecting a regulated broker:

- Regulatory Compliance: Check that the broker is regulated by a reputable authority. Always ensure they display their licensing information on their website.

- Client Reviews and Reputation: Research the broker’s reputation by reading client reviews and testimonials. Look for red flags, such as poor customer service or unresolved complaints.

- Trading Conditions: Evaluate the trading conditions offered by the broker, including spreads, leverage, and margin requirements. Ensure they align with your trading strategy and risk appetite.

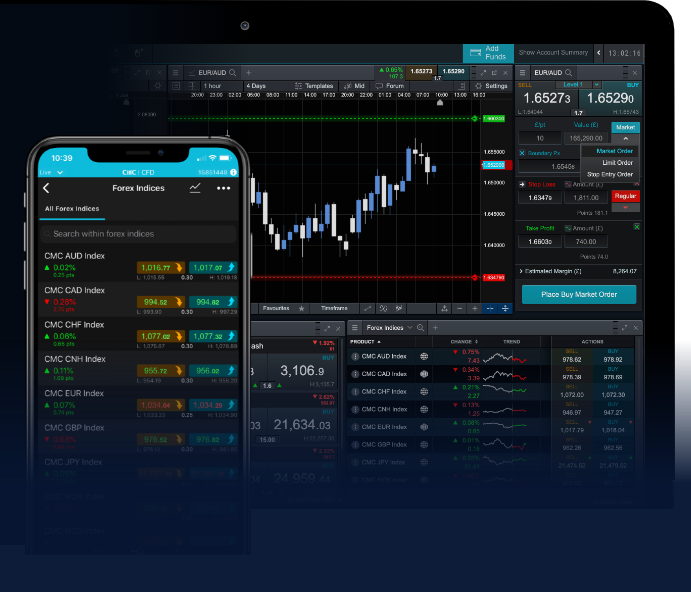

- Trading Platforms: Test the broker’s trading platform, ensuring it is user-friendly and filled with the necessary tools for effective trading.

- Customer Support: Good customer support is essential in trading. Ensure the broker offers responsive and knowledgeable customer service channels.

Conclusion

Forex trading regulations play a crucial role in creating a safe and secure trading environment. Understanding the regulatory framework that governs the forex market is essential for all traders. Not only does it help protect your investments, but it also enhances your trading experience by ensuring fairness and transparency.

As you embark on your forex trading journey, always prioritize working with regulated brokers, understanding the implications of regulations, and keeping yourself informed about the evolving regulatory landscape. Your success in forex trading is not just about strategy and market analysis; it also heavily relies on adhering to compliance and selecting the right partners.

In addition to understanding these regulations, utilizing the best tools available, such as Forex Trading Apps, can further aid your trading experience, enabling you to stay updated and compliant on the go.

Leave a Reply