What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, is the act of exchanging one currency for another with the aim of making a profit. The Forex market is the largest and most liquid financial market in the world, with an average daily volume exceeding $6 trillion. Investors, companies, central banks, and other entities use Forex trading for various reasons, including speculation, hedging, and international trade. For more information about Forex trading, visit what is trading forex fx-trading-uz.com.

The Basics of Forex Trading

At its core, Forex trading involves the buying and selling of currency pairs. A currency pair consists of a base currency and a quote currency. For instance, in the currency pair EUR/USD, the Euro is the base currency and the US Dollar is the quote currency. When you buy this pair, you are buying Euros and simultaneously selling US Dollars. Conversely, selling this pair means you are selling Euros and buying US Dollars.

The value of a currency pair fluctuates due to various factors, including economic indicators, political events, and market sentiment. Traders utilize different strategies and tools to analyze these movements and make informed decisions.

How Forex Trading Works

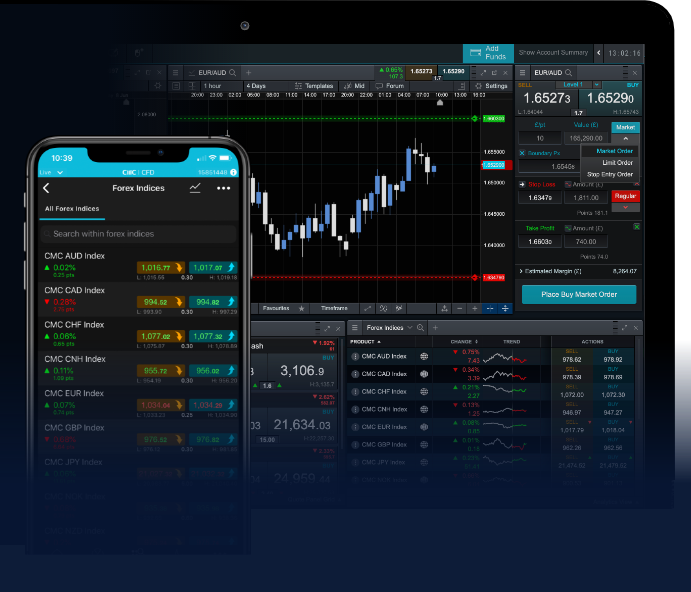

Forex trading occurs over-the-counter (OTC), meaning that it does not take place in a centralized exchange. Instead, transactions occur directly between parties, typically through digital platforms provided by brokers. These brokers facilitate the execution of trades by offering a trading platform where individuals can analyze the market, execute trades, and manage their accounts.

Trades can be executed in several ways: spot trading, forward contracts, and futures contracts. Spot trading is the most straightforward, where currencies are exchanged at the current market rate. Forward contracts set a future date for the exchange, while futures contracts are standardized agreements traded on exchanges.

Key Terms in Forex Trading

To navigate the Forex market successfully, it’s essential to understand some key terms:

- Leverage: This allows traders to control larger positions with a smaller amount of capital. While leverage can increase profits, it also increases potential losses.

- Spread: The difference between the buying (ask) price and selling (bid) price of a currency pair. It represents the broker’s profit on each trade.

- Pip: A pip is the smallest price movement in a currency pair, often referred to in the fourth decimal place.

- Margin: The amount of capital required to open and maintain a leveraged position.

Types of Forex Traders

Within the Forex market, traders are typically categorized into three main types based on their trading styles and time frames:

- Scalpers: Traders who aim to make small profits from numerous trades throughout the day, often holding positions for just seconds or minutes.

- Day Traders: Individuals who open and close trades within the same day, avoiding overnight risk.

- Swing Traders: Traders who hold positions for several days to capitalize on expected price moves.

Strategies for Trading Forex

Successful Forex trading requires a solid strategy. Common strategies include:

- Technical Analysis: Traders use charts, indicators, and patterns to identify entry and exit points based on historical price movements.

- Fundamental Analysis: This strategy involves evaluating economic indicators, news events, and geopolitical factors to predict currency movements.

- Sentiment Analysis: Traders assess market sentiment to gauge whether the market is bullish or bearish, adapting their strategies accordingly.

Risks Involved in Forex Trading

While Forex trading can be lucrative, it also carries substantial risks. Traders may face volatility, market manipulation, and the risk of losing more than their initial investment, especially when using leverage. To mitigate risks, it’s essential to implement risk management strategies, such as setting stop-loss orders and taking only a small percentage of account equity on any single trade.

Getting Started with Forex Trading

If you’re interested in embarking on a Forex trading journey, consider the following steps:

- Choose a reliable Forex broker that offers a trading platform suitable for your needs.

- Create a demo account to practice your trading strategies without risking real money.

- Start learning about the market by utilizing educational resources, attending webinars, and following reputable financial news.

- Once you’re comfortable, open a live trading account and begin trading with a well-defined strategy and risk management plan.

Conclusion

Forex trading offers exciting opportunities for individuals looking to invest in currency markets. While it requires commitment, research, and risk management, anyone can learn to trade Forex with dedication and the right resources. By understanding the fundamentals, developing a trading plan, and practicing skilled trading strategies, you can navigate the complexities of the Forex market effectively.

Leave a Reply