What is Forex Trading?

Forex trading, short for foreign exchange trading, is the global marketplace for buying and selling currencies. The forex market operates 24 hours a day, five days a week, making it one of the most dynamic and accessible financial markets for traders worldwide. Let’s delve into the world of forex and understand what it entails. For more insights, visit what is trading forex fx-trading-uz.com.

1. The Basics of Forex Trading

At its core, forex trading involves the exchange of one currency for another. This currency exchange rate fluctuates based on various factors, including economic indicators, political stability, and market speculation. Every trade involves a currency pair, such as EUR/USD (euro to US dollar), where you can speculate whether the base currency (EUR) will rise or fall against the quote currency (USD).

2. How Forex Trading Works

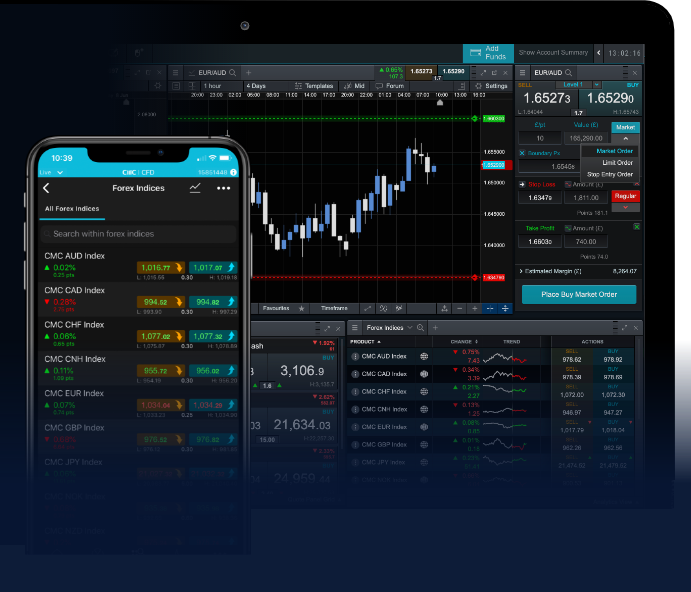

Forex trading is typically conducted through brokers who facilitate trades and provide trading platforms. Traders can execute trades using various methods, including:

- Spot Markets: The most direct form of trading, where currencies are bought and sold for immediate delivery.

- Forward Markets: Contracts to buy or sell currencies at a future date and at a predetermined price.

- Futures Markets: Similar to forward contracts but standardized and traded on exchanges.

- Options Markets: Contracts that give the right, but not the obligation, to buy or sell currencies at a set price within a specific period.

3. Major Currency Pairs

In forex trading, currency pairs are categorized into three main types:

- Major Pairs: These include the most traded currencies globally, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: Less traded pairs that do not involve the USD, such as EUR/GBP and AUD/NZD.

- Exotic Pairs: These consist of a major currency paired with a currency from a developing economy, such as USD/TRY (US dollar/Turkish lira).

4. Why Trade Forex?

The forex market attracts millions of traders, from individuals to large institutions. Here are some reasons why many individuals choose to engage in forex trading:

- High Liquidity: With a daily trading volume exceeding $6 trillion, forex is the most liquid market in the world.

- Accessibility: The forex market is accessible to anyone with an internet connection and a trading account, allowing for low barriers to entry.

- Leverage: Forex brokers often offer leverage, allowing traders to control larger positions with a relatively small amount of capital.

- Variety of Trading Strategies: Traders can employ various strategies based on their risk tolerance and market understanding, including day trading, swing trading, and position trading.

5. Risks Associated with Forex Trading

While forex trading offers many opportunities, it is also accompanied by significant risks. Traders should be aware of:

- Market Volatility: Currency values fluctuate rapidly, and while this can lead to profits, it can also result in substantial losses.

- Leverage Risk: While leverage can amplify gains, it can also magnify losses, leading to a margin call if your account balance falls below a certain threshold.

- Counterparty Risk: The risk that a broker or financial institution may default on their obligations.

- Regulatory Risk: Changes in government regulations may impact trading conditions.

6. Popular Trading Strategies in Forex

Traders utilize various strategies to navigate the forex market effectively. Some of the most popular strategies include:

- Scalping: Involves making numerous trades throughout the day to capture small price movements.

- Day Trading: Traders open and close positions within the same day, avoiding overnight risk.

- Swing Trading: Traders hold positions for days or weeks, aiming to profit from short- to medium-term price trends.

- Position Trading: Long-term strategy that involves holding positions for months or years, based on fundamental analysis.

7. Getting Started with Forex Trading

If you are interested in entering the forex market, consider the following steps:

- Educate Yourself: Understand basic concepts, trading strategies, and the economic factors that influence currency prices.

- Choose a Reliable Broker: Look for a regulated broker with a good reputation and transparent fees.

- Open a Trading Account: Start with a demo account to practice trading without risking real money.

- Develop a Trading Plan: Identify your trading style, set risk management rules, and establish clear entry and exit strategies.

- Start Trading: Once you feel confident, you can start trading with small amounts of real capital.

Conclusion

Forex trading offers a unique opportunity to engage in the world of currency exchange and potentially earn a profit. However, it is essential to approach it with a solid understanding of the market, well-defined strategies, and a clear awareness of the inherent risks. Whether you are a beginner or an experienced trader, continuous learning and adaptation will be key to successful trading in the forex market.